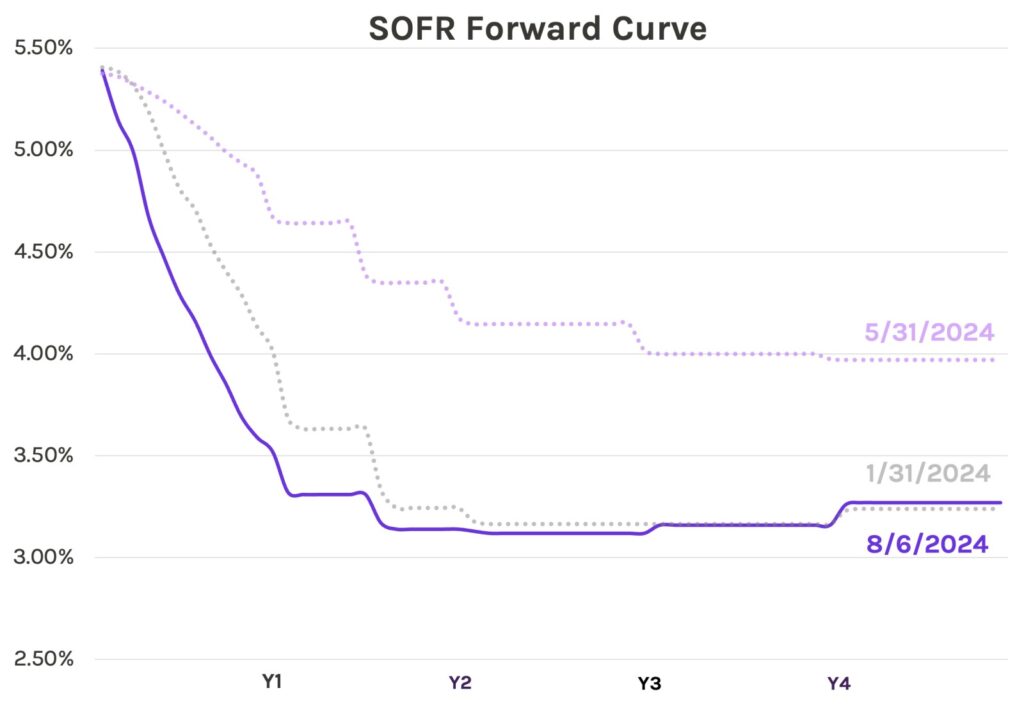

With a September rate cut now priced in, today’s forward curve closely resembles the curve we last saw in January.

Regardless of the Fed’s decision in September and beyond, the market now clearly perceives the risk to rates as tilted to the downside. This shift has significant implications for depository hedging programs:

Institutions with pay-fixed swaps face a dilemma. On one hand, these hedges continue to contribute meaningfully to earnings, as several institutions shared during their Q2 earnings calls and in prior quarters. The recent price action has also made executing additional pay-fixed swaps even more appealing for those still concerned about a “higher for longer” scenario. However, these same hedges increase exposure to declining rates and could reduce earnings if the Fed cuts policy rates. We’ve previously discussed how institutions can restructure these positions to mitigate downside risk and we expect these discussions to broaden in Q3.

Depositories exposed to lower rates will begin to hedge in earnest, but will it be fast enough? For several years, asset sensitive institutions have seen earnings headwinds from receive-fixed swap and floor hedges. The institutions who have proactively hedged despite that negative carry may suddenly find themselves well positioned. A steepening yield curve may provide a more attractive entry point for additional hedges but as recent price action shows, the market can be unpredictable.

As we approach a potential inflection point in the interest rate cycle, these earnings calls provide insights into how peer institutions are positioning their hedging portfolios. Read on for our complete summary from Q2.