May 2025 Highlights

3 Things to Know:

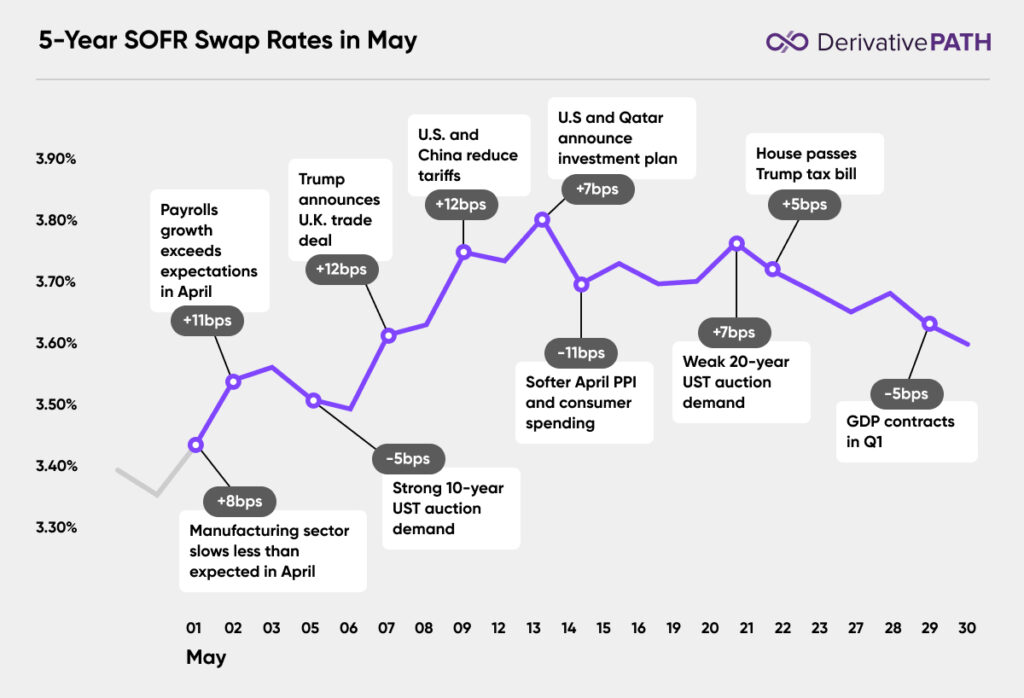

- Rate volatility moderates. After climbing ~40bps to a 2-month high in mid-May, rates steadily declined to end the month ~15bps higher.

- Confidence in U.S. credit wavers. Moody’s U.S. credit downgrade on budget deficit concerns and a weak long-term UST auction sparked fears that the UST’s role as a global haven asset were being reevaluated. Those fears eased after the House passed Trump’s tax bill, but uncertainty remains.

- Trade progress stalls. Positive developments with certain trading and investment partners during the first half of the month were overshadowed by roadblocks with the E.U. and China. Discussions continue, but the outlook remains uncertain.

Explore More:

- ISM Manufacturing Data (+8 bps)

- April Payrolls Data (+11 bps)

- 10-Year US Treasury Auction Summary (-5 bps)

- U.S. – U.K. Trade Deal (+12 bps)

- U.S. and China Reduce Tariffs (+12 bps)

- U.S. – Qatar Investment Plan (+7 bps)

- April Consumer Spending and PPI (-11 bps)

- 20-year UST Auction (+7 bps)

- House Passes Tax Bill (-5 bps)

- 1Q25 GDP Contraction (-5 bps)

Contact us:

415-992-8200

[email protected]